We're watching the same pattern we've been tracking in AI infrastructure play out at the hardware level: organizations are choosing ownership over rental agreements.

The implications reach far beyond chip design. This milestone reveals where technology infrastructure is heading, and more importantly, why the shift toward owned assets has become inevitable rather than optional.

The End of the Proprietary Duopoly

For decades, you had two choices for processor architecture: x86 from Intel or ARM from ARM Holdings.

Both operated as black boxes. You paid licensing fees. You accepted their roadmap. You built on their terms.

RISC-V changed the equation by releasing specifications under permissive open-source licenses. No royalties. No per-chip fees. No vendor lock-in.

The architecture allows engineers to add custom extensions specifically for their workloads. While Intel and ARM offer fixed instruction sets, RISC-V lets you build proprietary competitive advantages directly into your hardware.

This matters because customization creates assets, not just efficiency gains.

When Meta Platforms acquired Rivos and Qualcomm spent $2.4 billion on Ventana Micro Systems, they weren't buying tools. They were building owned infrastructure that reduces dependency on external hardware vendors.

Meta's senior director of engineering stated plainly: "We've identified that RISC-V is the way to go for us moving forward for all the products we have in the roadmap."

That includes next-generation video transcoders, inference accelerators, and training chips. Meta expects to save billions in capital expenditure over the next five years by owning their hardware stack rather than renting it.

The Hidden Tax of Proprietary Infrastructure

ARM's business model charges royalties on every chip manufactured using their architecture.

This creates a permanent tax on your infrastructure. Every unit you produce, every device you deploy, every expansion you execute generates revenue for ARM.

RISC-V eliminates this extraction mechanism.

The royalty-free nature reduces development costs by as much as 50% in some implementations. Smaller companies can now design, prototype, and manufacture specialized chips without prohibitive licensing fees.

We see the same dynamic in cloud AI infrastructure. Organizations pay subscription fees that accumulate indefinitely while building zero owned assets. The efficiency gains are real, but the long-term economics favor the vendor, not the customer.

The smartest organizations recognize this pattern and invest in ownership instead.

China understood this immediately. By late 2025, China accounted for nearly 50% of global RISC-V shipments. The Chinese government mandated RISC-V integration into critical infrastructure across finance, energy, and telecommunications.

This wasn't about technology preference. It was about building a resilient, indigenous tech stack effectively immune to Western export bans.

The European Union followed similar logic. Under the EU Chips Act, hundreds of millions of euros flowed into RISC-V development to reduce reliance on US-designed x86 and UK-based ARM architectures.

As one EU official noted: "RISC-V is the Linux of hardware. It is an open-source ISA that no one company owns. This makes it an attractive option for the E.U., as it allows for greater flexibility and security."

Nations grasp what many organizations still miss: ownership equals control, and dependency equals vulnerability.

Performance Parity Destroys the Cloud Myth

The standard objection to local infrastructure has always centered on performance.

Cloud providers argue that centralized resources deliver capabilities impossible to replicate locally. This reasoning justified surrendering data control and accepting permanent subscription costs.

RISC-V's trajectory demolishes this argument.

Experts project performance parity between high-end ARM and RISC-V CPU cores by the end of 2026. The architecture has transitioned from "low-cost alternative" to "high-performance necessity."

In AI workloads specifically, RISC-V demonstrates approximately a 3x advantage in computational performance per watt compared to ARM and x86 architectures in certain contexts.

The RISC-V community is finalizing the Vector-Matrix Extension (VME), introducing outer product formulations for matrix multiplication. This enables high-throughput AI inference with significantly lower power draw than traditional designs.

At CES 2026, DeepComputing showcased the DC-ROMA RISC-V Mainboard II for the Framework Laptop 13. Powered by the ESWIN EIC7702X SoC and SiFive P550 cores, this system delivers an aggregate 50 TOPS (trillion operations per second) of AI performance.

You can now purchase this hardware and run local AI workloads on fully open-source architecture.

This validates what we've observed in our diagnostic work: local infrastructure can match cloud performance when properly implemented.

The performance gap was never technical. It was an awareness gap combined with vendor marketing that obscured viable alternatives.

AI Workloads Accelerate the Ownership Shift

Generative AI created the perfect conditions for RISC-V's acceleration.

The explosive demand for AI compute revealed the limitations of proprietary architectures. Organizations needed customization, efficiency, and control that fixed instruction sets couldn't provide.

RISC-V International credits growth to Edge AI deployments—localized data hubs serving specific communities rather than routing everything through general cloud infrastructure.

This architectural shift mirrors the broader pattern we track: moving intelligence closer to where data originates and decisions execute.

The data centers and HPC segment represents the fastest-growing RISC-V application, expanding at a 33.1% CAGR from 2025-2034. Growth stems from adoption in hyperscale computing, AI model training, and high-performance parallel processing where customization and energy efficiency are essential.

The global RISC-V market reached $1.76 billion in 2024. Projections show growth to $8.57 billion by 2030, with revised estimates suggesting 21+ billion chips shipped by 2031.

This acceleration occurred because AI workloads exposed the cost of dependency.

When you process proprietary data through cloud AI services, you transfer information into third-party training systems. When you rely on vendor-controlled hardware, you accept their roadmap constraints and licensing terms.

Organizations building serious AI infrastructure recognized that these trade-offs don't scale favorably over time.

What This Means for Infrastructure Decisions

The RISC-V milestone reveals several patterns that apply beyond semiconductor architecture.

First: Open-source infrastructure can achieve performance parity with proprietary alternatives.

The myth that ownership requires sacrificing capability has been empirically disproven. Local infrastructure, properly implemented, matches centralized performance while maintaining data control.

Second: Customization creates competitive advantage that generic solutions cannot provide.

When you own your infrastructure, you can optimize for your specific workloads. This builds proprietary assets rather than consuming commodity services.

Third: The smartest organizations invest in ownership despite higher initial complexity.

Meta, Google, Amazon, and national governments aren't choosing RISC-V for convenience. They're choosing it because owned infrastructure becomes a sellable business asset that increases organizational valuation.

Fourth: Awareness gaps persist longer than technical gaps.

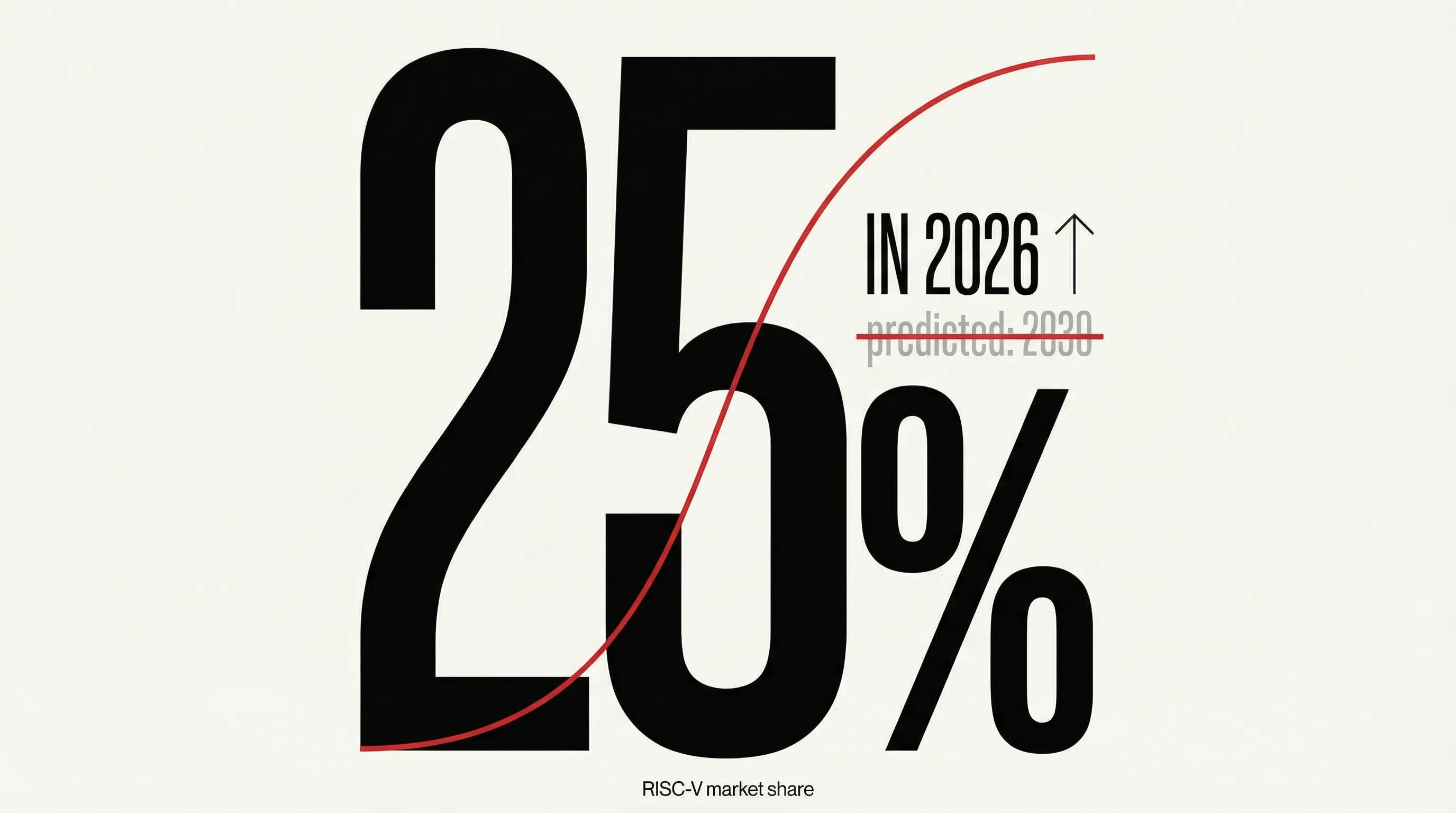

RISC-V achieved performance parity years before reaching 25% market share. The delay wasn't technical—it was educational. Decision-makers didn't know the alternative existed or believed it viable.

We observe identical dynamics in AI infrastructure. Local deployment of open-source models achieves cloud-equivalent performance, but awareness lags behind capability by years.

The Asset-Building Paradigm

RISC-V represents more than a technical architecture.

It demonstrates a philosophical shift: technology infrastructure as owned asset rather than rented dependency.

When you build on RISC-V, you create intellectual property that increases your business valuation. When you build on proprietary architectures, you create vendor dependency that decreases your negotiating position.

The same logic applies to AI infrastructure.

Organizations deploying local AI systems on open-source models build proprietary intelligence layers that remain within organizational boundaries. This infrastructure becomes a transferable business asset.

Organizations relying exclusively on cloud AI services build operational efficiency but zero owned assets. The intelligence accumulation benefits the service provider, not the customer.

The RISC-V trajectory shows that organizations eventually recognize this distinction and shift toward ownership.

The transition isn't instant. It requires upfront investment, technical capability, and willingness to prioritize long-term asset accumulation over short-term convenience.

But the economic logic becomes undeniable over time.

Predictions: Where This Goes Next

Based on RISC-V's acceleration and the underlying forces driving adoption, we can project several developments over the next 24-36 months.

Hardware Sovereignty Becomes Standard Practice

More nations will mandate open-source hardware architectures for critical infrastructure. The geopolitical advantages of eliminating foreign dependency outweigh the convenience of established proprietary systems.

We'll see government incentives specifically targeting RISC-V adoption in defense, telecommunications, energy, and financial systems. This creates guaranteed demand that accelerates ecosystem development.

AI-Optimized RISC-V Chips Reach Consumer Markets

The specialized AI capabilities being developed for data centers will trickle down to consumer devices. Laptops, tablets, and edge devices with native RISC-V AI acceleration will become commercially available.

This enables practical local AI deployment for organizations currently locked into cloud-only approaches due to hardware limitations.

Proprietary Architectures Shift to Hybrid Models

ARM and Intel will respond by offering more flexible licensing terms and customization options. They'll position themselves as "open enough" while maintaining revenue streams.

This defensive positioning validates the ownership model but doesn't eliminate the fundamental extraction mechanism. Organizations will still pay ongoing fees rather than building owned assets.

The Semiconductor Industry Fragments

RISC-V's accessibility will spawn hundreds of specialized chip designers targeting specific workloads. The era of general-purpose processors dominating all applications will end.

This fragmentation mirrors what happened in software when open-source eliminated barriers to entry. We'll see explosion in diversity followed by consolidation around proven implementations.

Cloud Providers Adopt RISC-V Infrastructure

Major cloud platforms will deploy RISC-V-based servers to reduce their own infrastructure costs. This creates an ironic situation where cloud providers build owned assets while customers remain renters.

The smart response: if RISC-V delivers sufficient cost savings for hyperscalers, it delivers even greater advantages for organizations building their own infrastructure.

Data Sovereignty Regulations Accelerate Adoption

As governments implement stricter data residency and control requirements, organizations will need local infrastructure capable of matching cloud performance.

RISC-V provides the hardware foundation for this transition. Combined with open-source AI models, organizations can build fully sovereign intelligence infrastructure.

The Ownership Premium Becomes Quantifiable

As more organizations complete the transition to owned infrastructure, we'll develop clear financial models comparing total cost of ownership versus perpetual subscription.

These models will reveal that the break-even point arrives faster than most decision-makers currently assume.

Organizations operating on 3-5 year planning horizons will recognize that ownership investment pays for itself within their strategic timeframe.

The Broader Pattern

RISC-V's 25% market share milestone confirms what we've been observing across technology infrastructure.

The shift from rental to ownership isn't a niche movement. It's a structural transition driven by economic reality and strategic necessity.

Organizations that understand this pattern early gain competitive advantage. They build assets while competitors accumulate expenses. They create proprietary capabilities while competitors consume generic services.

The hardware sovereignty revolution and the AI infrastructure ownership movement stem from the same recognition: dependency is expensive, and ownership creates value.

RISC-V reached 25% market share four years ahead of predictions because the underlying logic is sound. Organizations benefit from controlling their infrastructure rather than renting it indefinitely.

This pattern will continue accelerating.

The question isn't whether ownership-based infrastructure will dominate. The question is which organizations recognize this trajectory early enough to benefit from the transition rather than being forced into it by competitive pressure.

We're watching the future of technology infrastructure take shape. It looks like ownership, sovereignty, and asset accumulation rather than subscription, dependency, and perpetual rental.

The organizations building accordingly will own the next decade.

References

- TokenRing. (2026, January 1). The Open Silicon Revolution: RISC-V Hits 25% Global Market Share as the "Third Pillar" of Computing. Financial Content.

- TokenRing. (2025, December 26). RISC-V Hits 25% Market Penetration as Qualcomm and Meta Lead the Shift to Open-Source Silicon. Financial Content.

- RISC-V International. (2025, November 3). RISC-V International to Announce 25% Market Penetration. RISC-V International Blog.

- Tom's Hardware. (2025, October 9). RISC-V set to announce 25% market penetration.

- GM Insights. (2025). RISC-V Market Size, Share & Growth Report, 2025-2034.

- Next Platform. (2025, October 2). Meta Buys Rivos To Accelerate Compute Engine Engineering.

- Data Center Dynamics. (2025, October 1). Meta acquires RISC-V chip startup Rivos.

- HPCwire. (2025, October 8). What Meta's Purchase of Rivos Says About RISC-V.

- The Register. (2025, December 10). Qualcomm takes RISC on Arm alternative with Ventana acquisition.

- Qualcomm. (2025, December 10). Qualcomm Acquires Ventana Micro Systems, Deepening RISC-V CPU Expertise.